Been a while since I shared an entry, but doesn’t mean I haven’t made them. After watching Jordi’s 23 minute webcast yesterday (link), I got the idea of doing my own market update this morning. While Jordi does a phenomenal job with the macro stuff, he rarely talks about companies, which is my focus.

Starting with the S&P – it is indicated down again this morning (noise) after two days of harsh selling (also noise). The 5-year chart below shows where the S&P stands versus the declining 150-day moving average. Jordi highlights in his video that we had two back-to-back months of positive returns, and that the market broke above the 200-day moving average. Nobody knows what comes next, and it is futile to base investment decisions on what the prognosticators think – even if it seems as if it is how most people invest. Jordi is bullish because he doesn’t think we will get a recession. While he and I share some opinions, we differ in how we chose to cope with the unknown. He tries to predict the next move and does so by frequently adjusting his views as the data changes. I prefer to let the most outstanding companies work for us over the long term, so that we don’t have to rely on the unreliable type of market predictions that Jordi makes. He is a “market” guy, and while I love following markets closely, our investment philosophy has little to do with “the market”. Most people think that to generate superior returns from investing in stocks, you must get the market right, but that depends on what types of stocks you buy, and for how long you own them. If you own low quality cyclical stocks because they are cheap or because you think interest rates, or oil, or orders, or next year’s earnings, will rise or fall, then for sure you better be right on markets. But if you own a collection of companies with incredible managements, formidable businesses, and durable, secular growth – and your gameplan is to own them for the long-term to see them get even more incredible, formidable, and durable – then what the “market” does in the near-term is irrelevant. What really matters is that the companies you choose remain outstanding. Trees don’t grow to the sky and companies don’t stay outstanding forever, and that is why we work so hard – to find and eliminate the ones that go bad before they hurt us. Its not easy, but its easier, and much more rewarding, than to trade in and out of markets based on the news of the day.

The Nasdaq did not break above its declining 150-day moving average. Growth is clearly still under pressure, even as inflationary pressures fade. Jordi didn’t show the Nasdaq chart in his presentation, but he made a comment about his view that Tech will lag.

This next image shows the 25 largest detractors in the S&P 500 year to date. With a few exceptions, they include some of the highest quality, best long term growth companies anywhere.

This next image shows the year-to-date attribution for the S&P 500 by GICS Sector. Energy is the only significant contributor, but even though the Sector is up 60% YTD, its weight in the S&P is only 4%. Tech is the largest detractor and by far the largest weight.

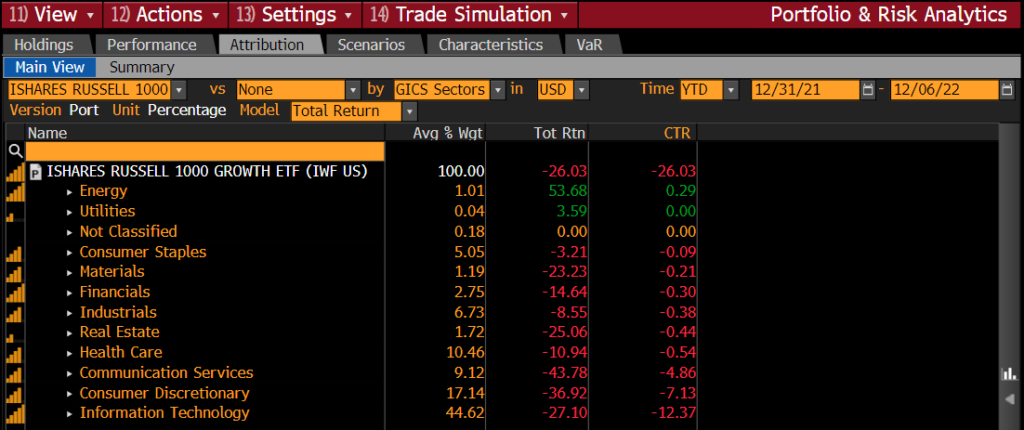

This shows the Sector attribution year-to-date for the Russell 1000 Large Cap Growth index. It is down about 10% more than the S&P this year, mostly because it has nearly half of its weight in Tech, and only 1% in Energy.

Here is the Sector attribution for the Russell 1000 Large Cap Value index. It is down 6.73% year-to-date, with nearly half of the return coming from Energy, which has nearly twice the weight that Energy has in the S&P.

Run the Sector attribution for the S&P on a 5-year basis and you will see that Tech is still by far the largest contributor.

Do the same for the Russell 1000 Growth index and you will see that the same holds true, with the Tech Sector up 140% in this 5-yr period, contributing to more than half of the 78.51% gross return.

Here is the 5-year Sector attribution for the Russell 1000 Large cap value index. Its up about half as much as the Russell 1000 Large Cap growth index. Not only is its average Tech weighting only 8.89%, but the Tech Sector with a “Value” label was up only 35.38% in the 5-year period. Beware of “Value Tech”.

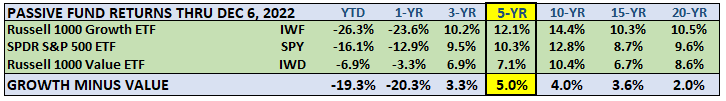

This compares the Russell 1000 Growth ETF to the S&P and the Russell 1000 Value ETF across multiple time periods of varying durations. It includes fees, which for ETFs are very low. While Growth is behind Value by a whopping 20% this year, it has outperformed in all other periods.

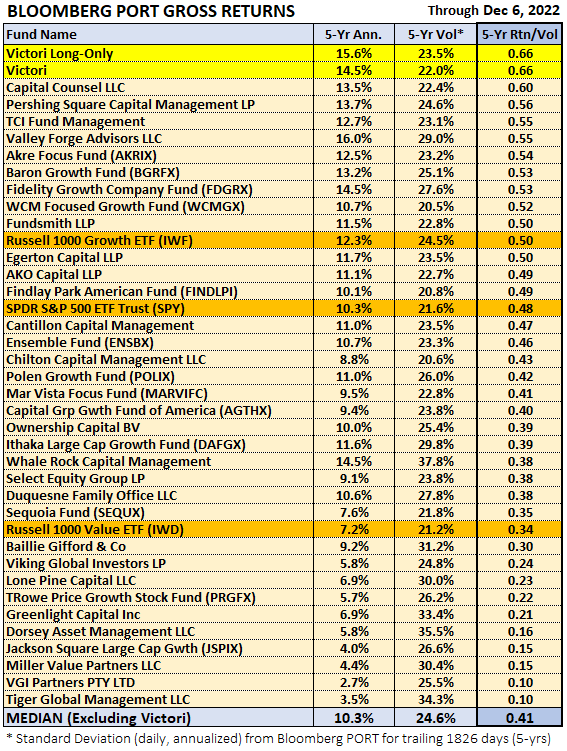

This shows our peer group performance table through yesterday’s close. The numbers all come from Bloomberg PORT and are gross of fees and trading costs.

Turning to interest rates – there is a lot of attention being paid to the fact that the yield curve is sharply inverted – with the 2-year US Govt yield nearly 1% higher than the 10-year yield. Many quant models out there flash recession whenever this happens, because every modern recession has been preceded by this signal.

This shows the yield curve today versus what it looked like at the beginning of the year. There are people who make a living out of trading the relationship between these yields. The short end is dictated by fed policy and they keep telling us they are not done raising, even as economic growth slows – which explains the hump on the left hand side. A few weeks back the 10-year yield was around 4.5%, but it came down fast after the lower than expected inflation reading was released – and then it came down more after Powell mentioned that they would reduce the pace of rate hikes. Jordi argues that the reversion is not necessarily bearish, but most people disagree with him. To me this curve is saying that the market believes the Fed will succeed in bringing down inflation. In a November 28 interview with the FT (link), Howard Marks made a comment that resonated with me: “The short run is by far the least important thing. What matters is the long run. We try to buy the stocks of companies that will become more valuable, and the debt of companies that will pay their debts. It’s very simple. Isn’t that a good idea?” Amen.

This chart shows how growth has continued to underperform and recently put in a 3-year low.

The dollar has been a problem for large US companies with global operations – especially the ones whose main cost is well-paid people working out of the US – like Google.

Oil stocks have done great this year, but oil prices just made a new low for the year.

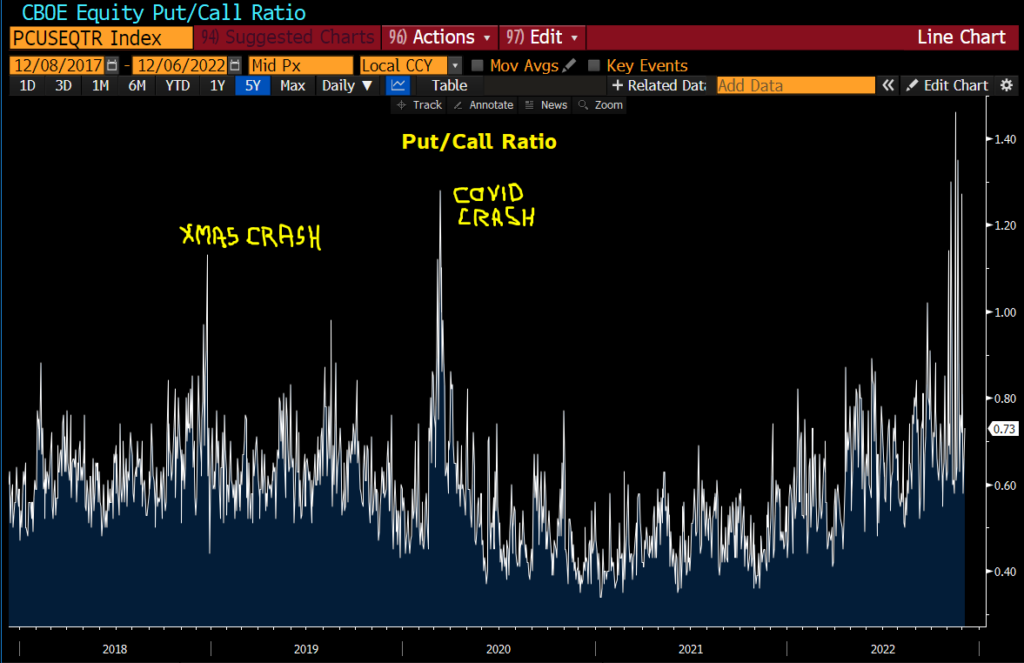

Jordi mentioned that people were really bearish and I have heard the same from others who go around talking to people about these things. This chart below shows the Put/Call ratio, which is a prominent short-term fear gage. When the ratio spikes, its because people are panicking. The last two times it spiked anywhere near these recent multiple spikes, there was a crash. This time it is doing it while the market puts in a rally, which is different, and strange.

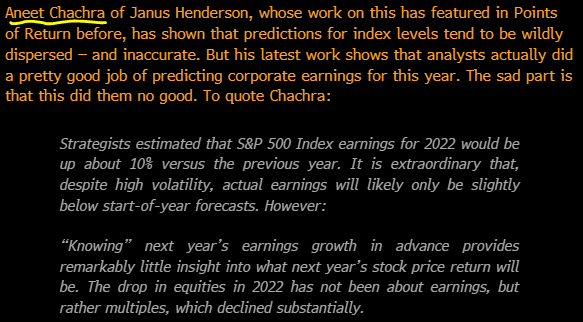

This morning I read an excellent article on Bloomberg by John Authers, who used to write the Lex column in the FT. He cites work by Aneet Chachra which points to how futile it is to rely on strategists for guidance on where the market is heading. Howard Marks makes this point forcefully in his first book, The Most Important Thing (2011). Barton Biggs did the same in Hedgehogging (2007), which was notable because Biggs is the guy credited with inventing the profession of Wall Street Strategist!

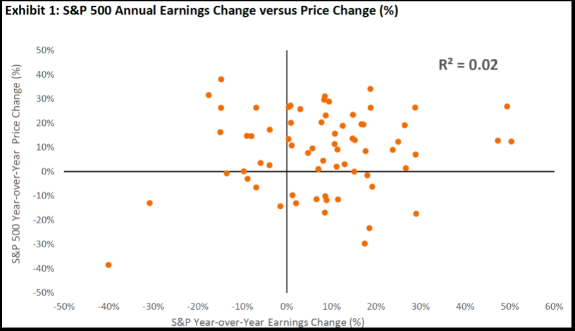

One of the fallacies of trying to predict stock prices is to assume that stocks move with earnings in the short term (i.e. 1-year periods). This chart below, from Auther’s piece, refutes such a thesis. A history of the P/E of the market or individual stocks does the same, as it wiggles wildly over time instead of staying near a mean.

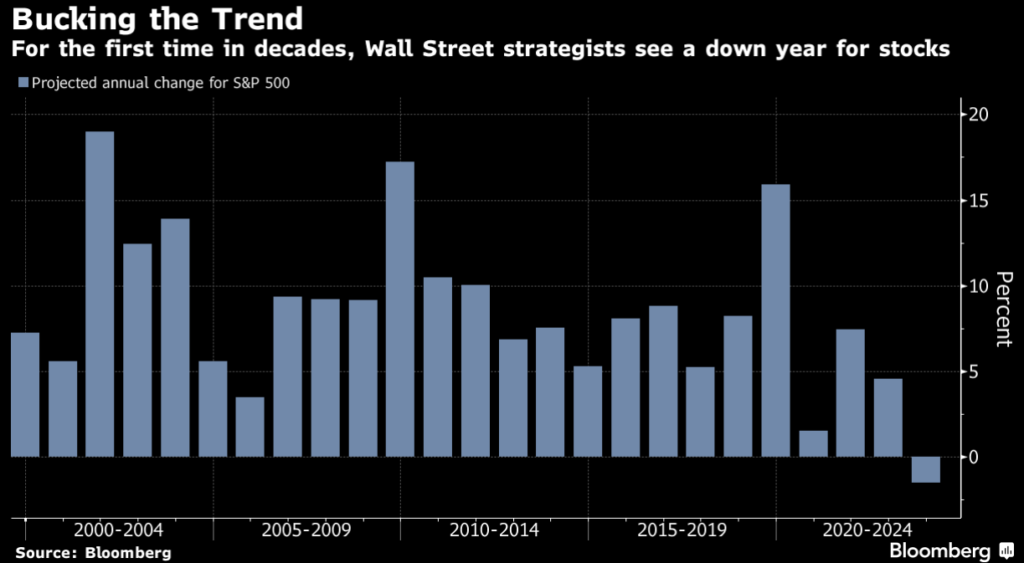

Jordi referred to this yesterday – and I suspect he got it from this article. In 25 years of doing this – I have never seen strategists predict as a group that stocks will fall in the following year.

Here are the conclusions from Authers’ piece. He had me at impossible.

Before I close, here are a couple of things I learned recently:

1. Its ok to say fishes.

2. Dogs and cats can also suffer from aortic stenosis.

3. ChatGPT is not as smart as it sounds.