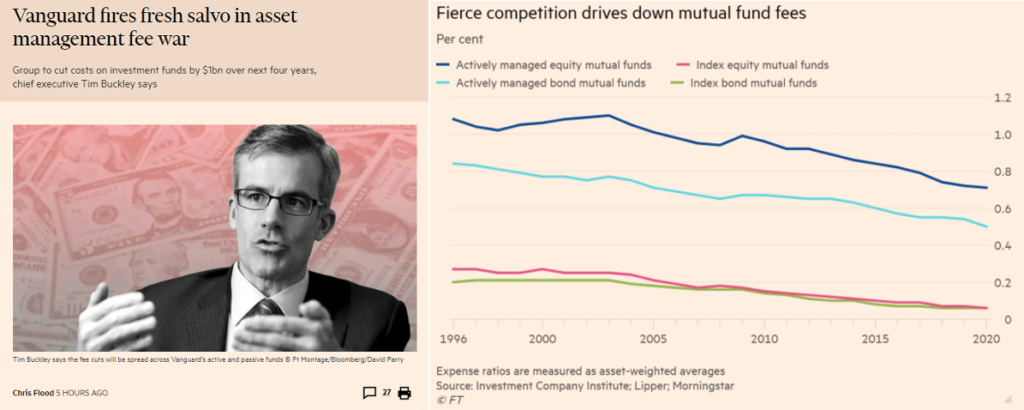

There’s an article in the FT today (link) about fierce competition in the fund business. This is nothing new, as the chart below shows, but it is also not as relevant as people make it out to be, in my opinion. The light blue line in the chart shows actively managed bond funds taking the biggest hit and that’s not surprising. It’s kind of criminal to charge high fees in a bond fund because bonds do not compound over the long-term and as such, they cannot make dreams come true.

When it comes to actively managed stock funds, selling or evaluating a fund based on fees is similar to selling or buying a car on price. GM and Ford do that on a regular basis, but Ferrari doesn’t. Want high performance? You have to pay way up for it! And as with Funds, there is a lot more to a Ferrari than just how fast it goes. But what’s performance in the fund business? That is complicated to answer because the performance that matters can only be received over long stretches of time.

Big dreams take decades to be delivered. It can’t apply to the past because the past already happened, but that’s not to say that funds that deliver big returns after you bought them, didn’t deliver value. But to see value in the rear-view mirror presumes one can exit at the top and find some other fund that can repeat the feat, when the objective is long-term compounding. Studies have shown that fund performance tends to mean revert, so there are people who sell their funds when they do too well. Doing that with Kathie Wood’s fund when she was up 150% in 2020 would have worked, but doing that with Lone Pine or Tiger Global or TCI, 10 or 20 years ago didn’t. The bottom line is that picking a fund is not easy, but neither is picking a lawyer, or a software programmer. It’s much more about outcome than price.

Whereas the utility of transportation can be delivered by the cheapest of cars, the cheapest of funds and lawyers and software programmers can confiscate dreams. There are some fund managers who deliver solid wealth creation while charging fair fees, but these fees are rarely below average. They may or may not be the best alternative, but you would not want to go for second best because of 100 or 200bps in fees, especially when the goal is to generate outsized returns. Do they have talent? Do they work hard? Do they really have the right mentality? Those are much more important questions than how much do they charge?

Working hard is not enough, but neither is having talent and not working hard enough. Unusual talent, when combined with passionate hard work and focus – that can command a premium fee, and it often does – much like Ferraris do. As a customer of any fund – it’s the value that you get, after fees and taxes, that really matters. But again, it’s not about what you got last year or might get three years from now. It’s about how wealthy a fund will make you 15 or 20 years from now. That’s the endgame, but if the model and culture and focus of a fund are not set right by design – it is not possible to get there. Not by my definition at least. A 17% annualized return after fees and taxes will take $1m to $100m in 30 years. A robo adviser running a balance stock/bond portfolio might give u 6% annualized before taxes. A 6% return turns 1m into only 5 million in 30yrs. If its 4% after taxes, that 1m barely hits 3 in 30yrs.

So in conclusion – as with stocks, dream makers rarely look cheap. They prove cheap.