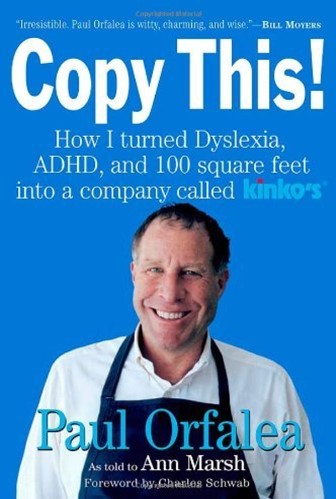

By Paul Orfalea (author), Ann Marsh (ghost writer), 2005 (248p.)

This was a precious book and a fast read. It is inspiring because it teaches the value of persistence. The reason Orfalea needs a ghost writer is that he is barely literate. While not book smart, however, he can read people. Even more importantly, though, is that he knows how to inspire them. This book is inspirational and I admit that it made me cry. He was very attached to his mother. He credits her with teaching him street smarts. She died a sudden death late in her life, while playing poker. My favorite passages are collected in the Highlighted Excerpts below, but I repeat my Top 5 here:

- How do you respond when a child comes to you with a painting that she did that day in kindergarten? If you’re like most people, you say, “That is beautiful, Sarah!” I don’t want to break your heart, but that is the wrong thing to say. Why not say, “Why did you paint that, Sarah? What does it mean to you?” Otherwise, you teach kids to please others, instead of pleasing themselves. It’s been observed that when five-year-olds draw trees, they draw messy, green blurs. By the time they are eight years old, they draw round circles with sticks. They’ve learned to draw like other people expect them to. I think the five-year-olds have it right.

- My brother once told me that studies have shown a trout will bite at a hook and circle back and bite on the same hook 17 minutes later. They’re automatons. They aren’t using their imaginations. Too many straight-A kids enter the real world primed to fall and to fall hard. They don’t know how to roll with the punches in either the workplace or life. They don’t know how to work through their setbacks. What we really want to produce in our kids is resilience. I may be sensitive, but I learned to be resilient, too.

- After partnering with so many difficult people, I got better at picking partners. It’s easier to accept a flub, of course, if you have great faith in the future. And I had great faith in the future of Kinko’s. When you stack up the losses of those early stores with what we all went on to build, they were trivial.

- Mother used to tell all of us, “In your twenties, try everything. In your thirties, figure out what you’re good at. In your forties, make money off what you’re good at. And in your fifties, do what you want to do.” That’s what my uncles did. As it happens I was 50 when I sold my first stake in Kinko’s.

- I have a couple informal rules of thumb I follow when selecting the people I work with, especially our partners. First off, they had to have the ability to save money. … I could tell right at the start whether they were a saver or a spender. I never want to do business with people who can’t save. … I [also] made sure to choose partners who were on time. I can’t stand it if people are late. By policy, I don’t keep people waiting and I expect the same in return.

What impressed me most about Orfalea was his passion for education and helping children succeed. But another thing that impressed me was how only towards the end of the book, he discloses he became a professional money manager and was the co-founder of West Coast Asset Management (WCAM), which was sold to the Lucia group in 2014. The firm’s website shows that he is still active, although their last newsletter (reproduced below the Highlighted Excerpts), is from 10 years ago.

Before closing, I should note that not everything about this book was perfect. I would still recommend it, but as with most memoirs, it’s heavy on self-praise and rationalizations. Maybe I am being too harsh, but Orfalea proudly explains how he and some partners started a separate financing company to lend to struggling franchisees while charging them above market rates. I am not saying the lending was necessarily predatory or conflicting, but I detected some moral hazard in the arrangement. Orfalea and his closer partners also owned a lot of the real estate for the more than 1000 stores, through a separate company. When they sold the company to private equity (before it got sold to Fedex), Orfalea used “cramdown” tactics to force all the franchisees to sell out. He admits to being a bully at times, and the book quotes several people describing him as being tough to work with. To his credit though, he made a lot of people rich.

All told – it’s a great book I’d recommend for many reasons beyond business. The closing sentences of the book brought it all home: “When I first get up, I think about what I want to think about. That’s freedom. I’m surrounded by nice, competent people. They are all far more capable than I at juggling a lot of details that require precision. They are so good at what they do that I no longer have to worry about busywork. With their help, I can get into as many, or as few, of the details as I care to. My life is still built on partnerships. And it still runs on trust. It’s a dyslexic’s dream.”

Have a great weekend!

Cheers,

Adriano

HIGHLIGHTED EXCERPTS

Fortunately, I was given an IQ test, scored 130, and rejoined the public school system. Still, things didn’t get much better. I may not have been able to read, but I could find my way to the principal’s office blindfolded. My typical report card came back with two C’s, three D’s, and an F.

This is one of the greatest lessons I learned from my own struggles, from my dyslexia, my restlessness, and what others call my ADHD or “attention deficit/hyperactivity disorder.” (I dislike using the term “deficit”; I don’t think it is one.) Doing life alone is not second best, it’s impossible. We need other people. We need to know how to talk with them, argue with them, build with them, and introduce ourselves to them. We need a push. It’s funny to think that human beings forget this fact, especially the straight-A types. [AA Comment: Reminds me of the Marcel Duchamp quote: There is no solution because there is no problem.]

I first picked up credits at Los Angeles Valley College, then talked my way into USC’s regular degree program by starting with extension courses and taking classes with football players.)

Every major success I’ve had in my life has come about because I knew that somebody, often anybody, whether it was my wife, friend, or business partner, could do something better than I could.

No matter how busy I am, I still have the capacity to get bored. That’s the ADHD in me.

It wasn’t enough. I saw the impact of this lack of reflection on my father. In the seventies, he toyed with the idea of going into designer jeans. Gloria Vanderbilt and Calvin Klein made fortunes with this strategy a few years later. But Dad never gave himself a chance to explore his half-conceptualized dream. Dad also used to own beautiful land in Malibu that would be worth millions of dollars today. He sold that land and sunk the proceeds into the business. Later in life, I remember him reflecting that he should have done exactly the reverse. When he closed his clothing company, all the value he’d once held in that land vanished with it. Not only would he have made more money in real estate than in his business, but managing property would have allowed him far more free time to think and dream. And he was a very creative person. [AA Comment: Like many great achievers before him, Orfalea was critical of his dad and very attached to his mom.]

I never wanted to work with people I made money on; I wanted to work with people I made money with. “Coworker” became the official term to designate all of the people who worked with us at Kinko’s. [AA Comment: But that didn’t stop him from making money on his franchisees.]

I’ve never been shy about asking questions, so I tend to get a beam on people quickly.

From Mel Levine, an expert on learning differences and a best-selling author of books on the subject, I learned not to ask my kids, “How was school today?” but instead to ask them, “What questions did you ask today?” You’ll instill much better instincts into your kids and get a better answer to your own question. (Instead of warning my kids against substance abuse, for example, I like to hit them with off-handed questions like “What would you rather die of: cirrhosis of the liver or coughing to death from emphysema?” That gets them thinking.)

I have a couple informal rules of thumb I follow when selecting the people I work with, especially our partners. First off, they had to have the ability to save money. Most partners made an initial investment ment of as little as $2,000. It wasn’t a lot, but it was something. As with a good poker game, everybody had to buy his or her way in. In this way, I could tell right at the start whether they were a saver or a spender. I never want to do business with people who can’t save.

I made sure to choose partners who were on time. I can’t stand it if people are late. By policy, I don’t keep people waiting and I expect the same in return.

I also took time over drinks to find out about my potential partners’ family backgrounds.

I wanted to know if they had passion. Without passion, we could never work together.

I didn’t hire people who complained about tortured relationships with their mothers or fathers. I figured if they didn’t get along with their parents that probably meant they had trouble with authority. In all likelihood, they wouldn’t get along with me either. [AA Comment: This is a strange and harsh comment – especially for someone who shows so much empathy for children.]

I was kidnapped for a day and sexually molested by a neighbor a few years older than me when I was 14. He was jailed for the crime and I made the conscious choice to forgive him, but it’s possible that I have suppressed a good deal of anger over this experience.

The Paul Orfalea Personality Test

- Do I like them?

- Do they have passion?

- Do they get along with their family and parents?

- Are they bullshitters?

- Have they saved money?

- Are they honest?

- Are they kind to people whether it’s a waiter, a janitor, or a competitor?

- Do they arrive on time?

- Do they speak clearly?

- Do they have good follow-through?

- What are they like over a drink?

Taking Care of People: Another great way to manage the environment of a business is to offer people real incentives to work there. I don’t understand why more companies don’t take better care of their coworkers by offering them more perks and benefits. They cost so little and pay themselves back many times over in the loyalty and goodwill they inspire. As we grew, in the eighties, we offered 401(k) retirement plans to all our coworkers. Sometimes we had quite a job trying to convince our coworkers, most of whom were in their twenties, to divert money into their retirement accounts, but with some persuading many of them did. Our finance arm, Kinko’s Financial Services, which Jimmy, Dan Frederickson, our second president, and I started in the late eighties as an in-house financing arm to loan money to our partners, lent $15,000 to longtime coworkers to buy their first homes. In 1986, personal loss inspired my wife, Natalie, and me to build a daycare center for our coworkers at our head office in Ventura. That year, our first-born son, Ryan, died of a congenital heart defect. Some things you never really “get over”; you just try to come to terms with them. Ryan was seven months old and had been doing well when he died unexpectedly. We were with him long enough to know he was a special boy, with mystical qualities. He could look at you and see straight into your soul. He had a shock of blond-red hair just as I did when I was a kid. We still keep photos of him in our house. Two years after we lost him, we opened a state-of-the-art daycare facility next to our head office in Ventura. [AA Comment: How tragic.]

A Fraction of the Action: The most tangible way we took care of our managers and all our coworkers, however, was by giving them “a fraction of the action.” Initially, we gave each manager 25 percent of his or her store’s profits. Later, we expanded the system of profit sharing when we started giving each manager 15 percent of the store’s profits and earmarking the remaining 10 percent to be split among that store’s coworkers. As I’ve explained before, my philosophy on this is twofold. Giving your coworkers a piece of the action is the best way to ensure their personal investment in your venture. There’s simply no better way to motivate the people you work with and to inspire their loyalty. In more general terms, I always figured I wanted a smaller piece of a bigger pie. I knew if I gave away ownership my partners ners would be highly motivated to grow their companies because they were owners.

My mom used to say, “Laugh and the world laughs with you. Cry and you cry alone.”

We also relied on silliness. Our annual picnic, which I’ll tell you more about later, gave us a chance to cut loose together at least once a year. In the early days, we ran advertisements in the local student newspapers that you wouldn’t exactly describe as brilliant. “If you can fart, you can copy,” read one. And another: “Even ax murderers make copies.” Stupid? Sure! But they drew in the college crowd. We abandoned all those sorts of ads in the early eighties, but their irreverence still makes me laugh.

People want to know they are contributing to society. If they made good tires, they knew they were keeping lots of babies, and their families, safe. [AA Comment: Purpose is key. Some great leaders say its everything. Victori’s purpose is to make dreams come true.]

Todd Ordal, a partner of ours based in the Midwest who made only $9,300 a year when he started with Kinko’s in 1980, put it this way: “People would say, for God’s sake, you’re just making copies, but we felt like we were saving the world.”

We had only about 80 stores by 1980, ten years after we were founded. [AA Comment: 80 is nothing compared to the 1000+ that would be added over the next two decades.]

As I got older, I discovered that to succeed in business you’ve got to dress like a Republican. [AA Comment: Everyone is entitled to their opinion. My opinion is that it’s not necessarily true. Steve Jobs didn’t even use deodorant.]

As Dan recalls, “I would take him out of a meeting and sit him down like a kid and say, `Paul, you’re a bully.’ Then he would get apologetic. I would tell him it would have been helpful if he had ever had a job working for somebody else.”

My wife convinced me to see a therapist a while back. He thinks -that a part of my personality split off because of the trauma of my struggles in childhood, including the sexual abuse I suffered.

“Integrity is like virginity-you only lose it once.” [AA Comment: Great quote!]

I asked him, “Are you losing any customers on pricing?” He said he wasn’t, and I said, “Well, start.” [AA Comment: Very interesting comment, but not sure I agree with it. Depends on the business, the purpose, and the exit strategy. One thing I detected in Orfelea was an obsession with money, which is not always productive, in my opinion.]

I believe that if you want to succeed in life, you can’t be late. [AA Comment: He really has a hang-up with this. I do too, but I find that more often than not in my business, people keep me waiting – and I find myself pretending its ok. I can see how it’s a cultural thing, though. Its like responding emails or Whatsapp messages. Some otherwise good people don’t, while others, like Carl Newport, advocate against it.]]

Most of the students I teach haven’t been taught how to behave in class or in social settings. They can barely put together an articulate sentence when you ask them a question. They either freeze up or they ramble on and on when they talk, never making their point. Here’s a simple rule of thumb in business: If they can’t say it in plain English, don’t work with them! [AA Comment: That’s too harsh, in my opinion, especially coming from a guy who has his fair share of faults and handicaps. Plain English? What if they are foreigners like his parents were?]

I think we’ve lost much of the art of speaking to one another. In my class, no one goes to sleep, because they don’t get a chance to. I force them to interact with me. I was the same way with our partners at our annual meetings. I homed in on the quietest ones and compelled them to tell all of us how things were going in their stores. At colleges and universities, most professors talk at their students. They don’t engage them in any dialogue. That is not how the real world works.

Out here in the real world, we need to be able to speak to one another, clearly and succinctly. When our partners sent me long-winded voice mails, I sent the message back to them so they could hear what their messages sounded like. Then I’d add the message “Too many words!” They called back and summed up their ideas more succinctly. [AA Comment: Ok, but “the real world” goes well beyond Kinkos and college. Some people just aren’t that good at engaging. Often times, the quiet ones make the most difference. Hitchcock, for instance, was a quiet man.]

My parents told us constantly when we were kids that the biggest cause of failure is your past success. Success too often goes to your head. Whatever the reason, in the wake of every setback, we’re left to claw our way up and out of adversity. We rethink our business strategies or our love lives. We rebuild our self-esteem brick by brick. It may be hard to pick up the tools of optimism and perseverance, especially if we are unaccustomed to using them. But we must.

Loss, especially loss in business, does produce something of exceptionally high value: information.

We struggled against daunting obstacles at Kinko’s right after we got started. In 1973, shortly after we opened our second location, my accountant tried to convince me to shutter the business. “You are not going to make it,” he told me. I sold the sailboat. I put the $8,400 in proceeds into the business. That was a difficult time. My father chipped in with loans to help out. But I was always afraid to ask and it was never enough to pay our bills on time. [AA Comment: This is why I love studying success stories. Very few were easy. Google and Facebook and Tiger Global and Fundsmith, are the exceptions.]

We weren’t just fighting with a vendor. We were fighting amongst ourselves, too. In the following decade, I ran into problems with at least a half dozen of our earliest partners. In each case, relationships had soured or simply weren’t working anymore.

For instance, after many years with Kinko’s, our hot-tempered office manager, Dottie Ault, convinced me to make her a partner in the original store on Pardall Road in Isla Vista. Big mistake.

I had to let go of a lot of partners as I simultaneously found new ones.

As my best friend, Danny, puts it, “If you’re real anal like I am, you respect people like Paul who can screw around and be messy, because you realize you don’t have to be perfect to succeed. Paul didn’t mind failing to become more successful.”

When a personal relationship or a business relationship goes bad, it’s a draining thing.

After partnering with so many difficult people, I got better at picking partners. It’s easier to accept a flub, of course, if you have great faith in the future. And I had great faith in the future of Kinko’s. When you stack up the losses of those early stores with what we all went on to build, they were trivial. [AA Comment: this is classic. Reminds me of Edison’s quote to the effect that failure is what happens to people who didn’t know how close they were to succeeding.]

We fought the suit with all we had. The National School Boards Association and the American Association of Libraries backed us, as well as other organizations with a strong interest in the free flow of intellectual ideas. There I was, basically illiterate myself, fighting for education.

Our revenues mushroomed from $500 million to more than $2 billion between 1990 and 2000. [AA Comment: That’s a 15% CAGR. Impressive, but not exactly rare. I’ve seen much bigger mushrooms.]

With all lessons in business, there is a corollary lesson in life. When I think of failure, I can’t help but think about our kids and how they suffer and struggle to grow during their schooling years.

Think about our kids. We give them awards when they do well in their studies, in sports or in performances. But what better time in life is there to fail than during school, while they are still at home? Kids don’t have to worry about paying the rent or going out of business. They should be encouraged to try as many new and different things as they can. Most important, they should learn to go through the experience of failure. Most straight-A types live in abject fear of failure. ure. They rack up all these perfect grades and think they will die if they come home with a B or a C. That’s no preparation for real life. Out in the real world, failure-and benefitting from it-is the name of the game. Straight-A types unaccustomed to failure enter the marketplace and take their first belly flops especially hard. They’re so shocked they don’t know how to react. Why do you think so many of them go back to graduate school? It’s a huge relief to return to the safety of a system through which they can navigate like trout. Our schools are producing test takers, not creative thinkers. My brother once told me that studies have shown a trout will bite at a hook and circle back and bite on the same hook 17 minutes later. They’re automatons. They aren’t using their imaginations. Too many straight-A kids enter the real world primed to fall and to fall hard. They don’t know how to roll with the punches in either the workplace or life. They don’t know how to work through their setbacks. What we really want to produce in our kids is resilience. I may be sensitive, but I learned to be resilient, too. [AA Comment: Halleluiah!]

Some kids just aren’t ever going to grasp the Pythagorean theorem. But they shouldn’t be stigmatized for the rest of their lives. We need to ask ourselves: Is this what we really want for our society and for ourselves? Do we really need all this eating-your-alphabet-soup-alphabetically perfectionism? Do we really want to learn how to do well on multiple choice tests? Or do we want to do well in life? [AA Comment: Pythagoras was an amazing man. I am currently reading a fascinating book titled Gurdjieff Reconsidered. Gurdjieff is an obscure philosopher from the 1940s who resembled Pythagoras in many ways, including in their obsession with knowledge. A sixth-century philosopher, mathematician, geometer, cosmologist, music theorist, school master, political counselor, dancer, healer, dietitian, and more – Pythagoras was a true renaissance man ahead of his times. My point in mentioning this is that you don’t have to understand Pythagorean/s mathematical theorems in order to understand his many teachings. Same for Gurdjieff, who was a very complex and controversial man – as well as a dance choreographer. Many of his contemporaries considered him a phony, but that, he was not.]

Let me ask you a question. How do you respond when a child comes to you with a painting that she did that day in kindergarten? If you’re like most people, you say, “That is beautiful, Sarah!” I don’t want to break your heart, but that is the wrong thing to say. Why not say, “Why did you paint that, Sarah? What does it mean to you?” Otherwise, you teach kids to please others, instead of pleasing themselves. It’s been observed that when five-year-olds draw trees, they draw messy, green blurs. By the time they are eight years old, they draw round circles with sticks. They’ve learned to draw like other people expect them to. I think the five-year-olds have it right.

I like to tell them what my dad said when he saw my brother Dickie up late, cramming for a test in high school once: “Go to bed,” he told my brother. “Why bother memorizing it when you’re going to forget it right after the test anyhow?”

As a dyslexic, I never lost sight of the fact that savings were going to get me much farther along in life than any report card ever would.

One time my friend Alan Porter told me your integrity is directly related to your liquidity, and I never forgot it. You sure don’t hear that in schools. Especially on college campuses, where it’s fashionable to look down on wealth-building.

If you’ve saved enough so that you’ve made investments in real estate or equities, you’ve got rent checks and dividend checks coming in. My whole life I’ve opted for rent checks and profit checks over paychecks. The greatest thing about real estate is that not only are you getting rent checks, the value of the property continues to rise. When I was 26 years old, I bought an apartment building with 4 units for $125,000. I sold it years later for $450,000. That made an impression on me, believe me. I was finally getting to the place where I was making money while I slept. [AA Comment: This is no different that what Larry Hite, who was dyslexic but also legally blind, concludes in his book The Rule.]

By 1980, I had bought about four or five properties. I started by putting money into apartment buildings and, by 1985, I owned ten or twelve. My period of greatest real estate expansion during my Kinko’s years was between 1985 and 1990, when I acquired another 50-odd properties. Wherever I could, I bought the buildings that leased commercial space to our Kinko’s locations. [AA Comment: Making money from his franchisees?]

The reason I was so keen to diversify into real estate goes back to something I heard from my mom. She once met a diamond merchant chant who sketched out the following diagram of lifetime wealth creation. I’ve reproduced this sketch on countless napkins in countless less bars with countless partners and coworkers over the years. Many of our partners bought into it completely, and they are wealthy people ple today as a result. It’s pretty simple and it goes like this. When you’re in your twenties, you don’t have excess money to stick into real estate, stocks, or savings, so the bulk of your net worth is concentrated centrated in your business. The allocation of your wealth looks something like this: When you’re 30, you’ve started to diversify and you’re diverting some of your assets into stocks and bonds. You’re becoming more liquid. Your portfolio looks like this: By the time you’re 40, you’ve begun to spread your resources evenly between your business, your savings, stocks and real estate. By the time you’re 50, you’ve shifted your assets out of business and primarily marily into savings and real estate. If you want to hang onto a little aggravation (like me), you keep a chunk of your money in business. The idea is you want multiple income streams. You want to be bulletproof, with interest, dividends, rent, and liquidity. This is not a new idea but, strangely enough, in our capitalist system, not too many people know about it. Look at the amount of credit card debt we have in our society. We’re raising sheep in our educational system, not independent thinkers and doers. As far as I’m concerned, the definition of owning your own business is making money while you sleep. If your business is so dependent on you and on your presence that you have to be there every minute of the day to make money, you don’t really own your business-your business owns you. Greg Clark, who started as our corporate counsel at Kinko’s, remembers a conversation we had along these lines years ago. “Paul would say, `I’m making money sitting here talking to you. You have to charge me $100 an hour because that’s the only way you get to make money.”‘ Nobody had put it to him quite that way before. It helped motivate vate Greg to change his line of work. A couple of years later he became a Kinko’s partner in Utah.

Mother used to tell all of us, “In your twenties, try everything. In your thirties, figure out what you’re good at. In your forties, make money off what you’re good at. And in your fifties, do what you want to do.” That’s what my uncles did. As it happens I was 50 when I sold my first stake in Kinko’s.

When I was younger, I was lucky to be able to compensate for my poor reading skills with an unusual facility with numbers. Back in second grade when I was stuck in a school for kids with mental retardation, my teachers noticed that I was a little too good at math to justify my placement alongside classmates with Down’s syndrome. In yet another attempt to teach me to read, one of them said, “To get you good at reading, we’re going to have to make you bad at math.” Good thing that plan failed. In my family, people talked about stocks and investing incessantly. santly. I listened to my father and my uncles as much as I could. When I was about 12 years old, I started ditching school and taking a bus into downtown Los Angeles to see a family friend named Charles “Chuck” Doud who was (and still is) a stock broker. I’d turn up at Chuck’s office, at the top of a high-rise building, and ask him to teach me about stocks and investing. Mom got wise. While Chuck was going over stocks with me, Mom would call and say, “Chuck, is Paul in your office?” Chuck would wave me out in the hallway and say, “No, he isn’t, Mrs. Orfalea.”

I got better and better at picking stocks over the years. One time, while I was in junior college racking up credits so that I could enroll at USC, I entered a stock-picking contest. Out of 500 entrants, I won! The ten stocks I’d picked outperformed everyone else’s. I was given five shares of a mutual fund as a prize. It was the only time that I can recall when a performance at school-though it didn’t involve class work-drew praise from my extended family. My desire to invest my money drove my interest in savings. My mom took me to the bank when I was about five years old. I had $6 saved and we deposited it.

Two times before I was 21, through scrimping and saving, I managed to save $5,000, which was a lot of money back in the sixties. Both times I lost all of it in bad investments in the bond market. The first time was through highly leveraged convertible bonds. When the Federal Reserve started regulating the convertible bond market, they lost all their value. I remember riding on a public bus one day when I heard a radio broadcast about the change. With a sinking feeling, I knew my entire investment was worthless. I lost my second $5,000 on highly leveraged junk bonds. Turns out I got burned by bonds long before the future “junk bond king,” Michael Milken, who, as it happens, was in my class at Birmingham High School. (When we met later in life, he rattled off a bunch of names to see if I recognized any of his friends. They must have all been straight-A types because I didn’t. I asked him, “Were any of them in woodshop?”)

I was 21 when I lost the money I’d made selling vegetables on highly leveraged junk bonds. I was engaged to my girlfriend at the time and suddenly out of cash. My best friend Danny’s older brother Dickran told me, “Orfalea, you’re so poor that if you get married now you’ll be eating leftovers.” I knew he was right. I postponed the wedding and my girlfriend broke up with me. While at the time I wished she hadn’t dumped me, in retrospect, losing the $5,000 was a good experience. I was starting to get cocky. I count myself extremely lucky for those two $5,000 reversals. They humbled me. By the time I got to college, I knew that the market wasn’t some two-dimensional board game. You could take real losses that caused real pain.

When Dr. Trefze saw how poorly I wrote, he snatched up one of my reports and took it to the admissions office. He demanded to know how a student like me was ever admitted to a place like USC. He hassled me constantly about my spelling. One day we were sitting in his class when Dr. Trefze asked all of us to calculate the dividend return on an IBM stock. Sitting next to me was one of those straight-A types. He and the other students pulled out their slide rules and started crunching numbers. I was accustomed to working out figures like dividend returns on the fly, so I did the calculation in my head. I called out the answer. “You’re wrong, Orfalea,” one kid near me said, quoting a much higher number; it was off by a factor of ten. If he’d ever actually invested in stocks, he would have known he was wrong. “No, I’m right,” I said softly. From the front of the room, Dr. Trefze announced, “Mr. Orfalea is right.” After that day, Dr. Trefze started to appreciate talents he’d overlooked. One day he pulled my best friend, Danny, aside and, within earshot of other students, said, “Tell Mr. Orfalea I won’t bother him about his spelling any more. Tell him I hear he’s on the brink of brilliance.” “You’re a diamond in the rough, Mr. Orfalea,” Dr. Trefze said to me later in his office. “You can sit behind any business desk in America that you want to.” This was extravagant praise, especially from someone one like Dr. Trefze. The support I received over the course of my life from supportive teachers like him (and several others at USC, including ing my finance professor, Professor Stancill) really helped turn my life around. They gave me confidence when I had none. That day Dr. Trefze told me about his work. He urged me to plan for my future wealth and to be sure that I gave back to my community. He told me to remember the enormous responsibility I would have to others, especially the people who would work with me. I suspect that part of the reason I teach college courses today is because of what I learned from him. For my part, I’ve already found other “Paul Orfaleas” in my classes. Two of my former students, Mark and Eric Jones-identical twins who were not even 30 yet-convinced me to invest in an Internet company several years ago. It made a huge return for everyone involved. Keep your eyes open. There are great ideas everywhere. [AA Comment: Its amazing the difference that a good teacher makes. They have the opportunity to change lives, yet sadly, many do not cease on it.]

Especially in the early years, I ran Kinko’s like a peddler. I didn’t follow a corporate model. In fact, I did just the opposite. I paid attention to cash flow, and I also paid attention to marginal cost-the cost required to produce one extra unit in any business.

Marginal cost is a very simple concept, but most businesspeople have no idea what theirs is. When scrutinizing any business, this is one of the first figures I nail down. It tells me something crucial about its viability.

As Kinko’s grew, one of the things which I became proudest of is that I learned to manage our cash flow – as far as I’m concerned the most important financial measure of any business.

I don’t really care where the money was yesterday. I want to know where the money is today and where it’s coming from tomorrow. At Kinko’s each partner gave me cash flow statements every month. I may not have read novels, but I poured over all of these statements as if they were The Da Vinci Code.

As John Davis once observed, “Paul paid attention to two things: people and cash.”

The main strategy we developed to contend with summer lows was the creation of Kinko’s Financial Services (KFS), the in-house financing arm that Jimmy, Dan, and I owned together. We started it to lend money to our partners when they needed funds to open new stores or improve their existing ones. We also used it both to pay all our bills to vendors like Xerox on time and to leverage our massive collective buying power.

It’s very difficult to pay taxes and manage your cash flow when you’re a growing business and you need resources to expand. The government takes away all your liquidity every April 15, June 15, September 15, and January 15. [AA Comment: Its one reason why they say: Sell in May and go away.]

Although our partners didn’t always like the high interest rates we charged through Kinko’s Financial Services, they were highly motivated to pay off their loans quickly. Dana Jennings from North Carolina remembers, “Paul got me to expand because he lent me money, but my goal was to get off the KFS chow line as soon as I could. We had to fight tooth and nail to get lines of credit from banks.” Partners like Dana were motivated to get out of debt, and fast. That bolstered our cash flow while KFS enabled lots of partners to expand when they couldn’t have done so otherwise. [AA Comment: So the higher than market interest rates helped them? Ok.]

Tne difference between the way other people see money and I see money is evident in my view of large public companies. I’ve got a pet peeve with these companies where the atmosphere is so cozy. I’ve noticed there are two types of people: those who deduct and those who capitalize.

In my family, every other word I heard as a kid was “deductible.” I may be dyslexic, but I can deduct. For the privilege of being a corporation, the government charges you 40 percent in taxes and your money is taxed twice: first as corporate income and then again as personal income. As a Subchapter S corporation, you pay only personal income taxes. The downside is that the owners shoulder tremendous personal liability. The upside is that your income is taxed only once. [AA Comment: One way to build wealth while paying fewer taxes is to invest in Outstanding Companies and let them work for you. The less you have to sell, the less you have to pay in taxes.]

FUNNY, ISN’T IT, HOW GOOFING AROUND CAN BE a good way to learn? Ask Bill Gates. When he was a freshman at Harvard, Gates spent more time playing poker than attending his classes. I can relate. Eventually Gates dropped out of Harvard and put the principles he was practicing in his poker games to work in the marketplace, and we all know what happened next. You won’t find a wilier outfit out there than Microsoft (nor many fortunes larger than Gates’s). Love it or hate it, you’ve got to admit that Microsoft, and Gates, know how to play the cards to their advantage. Other well-known business, political, ical, and legal minds play poker to sharpen their negotiating and deal-making skills-or just to make money. Richard Nixon paid his way through law school with his poker winnings. Other savvy players ers include Carl Icahn, the Wall Street financier, and Supreme Court Justices William H. Rehnquist and Antonin Scalia, to name a few. Not long ago, the head of the Chicago Board of Trade told me that the biggest predictor of success for future traders was not success cess in academics, but the amount of time they spent playing games as kids. I do my best to make up for this hole in the educational system tem in my world economics class at UCSB-I make poker and Monopoly part of the coursework every quarter. Typically, we divide each class into four to six subgroups. Each group picks a particular night to meet and I give them pizza money. We spend our subsequent quent classes discussing everything they learned (more on this later). Poker is such an engrossing game because it teaches players so many things at once. Whether they know it or not, when friends like Gates and his crowd gather to play poker, they are honing their skills in at least ten different areas simultaneously. Have you ever wondered dered why poker players look so intent when they’re deep in a game? It’s because their minds are working on so many different fronts at once. Among them: 1. Emotional control 2. Intuition 3. Circle of competence 4. Risk analysis 5. Human nature 6. Adaptability 7. Perseverance 8. Management of ambiguity 9. Luck 10. Patience

My younger cousin Lance Helfert and I, who run a money management company together called West Coast Asset Management LLC, both know people who study the stock market but don’t invest. They fancy themselves brilliant stock pickers, but they don’t have a clue how they might behave when their own money is at stake.

When I gamble with others, especially virgin rollers, I win. I like to gamble against the house. Once I win, then I can relax. I play with the casino’s money. While I love winning, the losses have been better for me, ultimately. They bring me back down to earth. When I lose, I have a tendency to brood. You see this phenomenon in the stock market when people can’t believe the value of a particular stock has dropped. They hang onto losers instead of cutting those losses and investing in winners. I think most people are brooders from time to time. I try to snap myself out of that state. Painful though it may be, losing kicks me into a healthy bout of reflection. My parents told me most fortunes are lost in the good times. People tend to overinvest in the good times. It’s just like when I lost all my money as a kid-twice. I thought I was invincible. It’s called hubris. The problem is that, in the good times, it’s hard to remember how bad things can go and how quickly they can go bad. Gambling refreshes the memory. Playing games of chance with money, like craps, poker, or betting on sports, checks your ego.

In order to conduct risk analysis in both business and in life, you’ve got to remember that your eyes believe what they see and your ears believe others, as a Chinese fortune cookie once told me. In The Prince, Niccolb Machiavelli takes this even further: “Generally men judge by the eye rather than by the hand, for all men can see a thing, but few men can come close enough to touch it. All men will see what you seem to be; only a few will know what you are.” [AA Comment: From a guy who claims he can’t read, its puzzling he can quote Machiavelli. Maybe he also uses the Kindle’s Read to Me feature.]

Dan now says I “controlled the situation by keeping everybody off balance. It’s called management through chaos.” Dan and I played good cop, bad cop with our friendly rivals. I think you can guess which part I got. [AA Comment: This strategy is straight out of Machiavelli’s writings, as well as several books on the art of Negotiation.]

Being a skeptic is different from being a cynic. One sobering lesson of life, business, and poker is this: Relationships that start out friendly do not always end up that way.

I always look for “cockroaches.” Whenever there is a problem with a potential partner’s ethics or with a potential investment’s financials, there are bound to be other problems you can’t see right away. The same principle held at all the different Kinko’s stores we used to visit around the country. A slovenly appearance meant there were other problems elsewhere. I could tell if it was a good or a bad store by the way workers looked me in the eye, by their demeanor. My intuition told me that. [AA Comment: My mom hates cockroaches and she also claims she can read people with a look in the eye. Indeed, growing up, it wasn’t easy for my brother and I to fool her. I may have inherited some of that from here. As I often joke, I dislike trouble and I can smell it coming like a fart in the car.]

Johnson & Johnson, which I mentioned earlier, is a good company because of both its research and development and its marketing prowess. But J&J’s company credo and selfless culture make it a great company. [AA Comment: Couldn’t agree more that culture is extremely important. Many investors compare earnings multiples across peer companies without even comparing the cultures.]

Don’t Pass Go Without Collecting a Lesson: Monopoly gives you a chance to watch marginal revenue in action when you build houses. If you buy Boardwalk, for instance, you pay $200 to build each house. For the first house, you get back only $200 in rent-not a great return. But the second and third houses pay you $600 and $1,400 respectively. Your marginal revenue on those two homes is the difference between the $200 you paid for them and what they produce in return: $400 and $1,200. You see that an extra increment of expense gives you a disproportionate tionate amount of income. This is a powerful lesson. But, for the most part, the students are too distracted to get it. They’re too impulsive. They have a real rough time with the concept. They’re “in” Monopoly and not “on” Monopoly. They haven’t yet learned how to focus. [AA Comment: In our house I usually win in Monopoly for this very reason. Just this morning I was coaching my younger son Oliver before he left for school, the importance of this concept. I think he understood, but we’ll see how he does in our next game.]

It’s no surprise that so many of the principles and aphorisms that guided our time at Kinko’s came directly from my mother. My mother taught me how to pay attention. She wasn’t a business owner herself, but she was raised by one and married to another. And she played games obsessively. When she played poker, she and her friends often played straight through the night to breakfast. When Mom couldn’t get a game together, she would sometimes drive to casinos, in City of Industry or Gardena, for example, and spend the night at the tables. She played obsessively, but she never pushed the envelope financially. She knew how to manage her risk. After my father died, Mom was still playing poker with the same friends and relatives with whom she’d been playing for 50 years. One night in 1988, during a game, Mom had a stroke and, a short while later, died. One minute, she was gambling with her sisters; the next minute she was gone. She was the first of her seven siblings to pass away. [AA Comment: Mothers are amazing. There is one behind most great men. Unfortunately, terrible men have loving mothers too, Hitler being just one example.]

After she was gone, one of her sisters came to me and handed me something. “These were her last chips,” she told me. “I think she would have wanted you to have them.” In her final gesture, Mom, who, like me, was a huge joker, made me laugh. She may have “cashed in her chips,” but it was as if she was urging me to keep playing.

Business schools mostly teach students how to build businesses, but they ought to offer a course on how to let them go, too.

Democracy’s Downside dd to that the fact that our democratic structure that gave birth to Kinko’s and fueled our growth, started to work against us once we grew to a certain size. [AA Comment: That’s because not every democracy is alike. As Alexis de Tocqueville points out in his seminal 1845 book, Democracy in America, the model does not work so well in societies that succumb to aristocratic behaviors and biases.]

Our lawyer Bob Montgomery oversaw the transaction from the legal end. And what a transaction it was. Here’s Bob: “Throughout the 127 Subchapter S corporations, there were close to 200 different owners involved. Each company operated differently. Some pulled hard while others sat back on their oars. Some partners had not been oriented as much to bottom line profitability and had been focusing primarily in building up their revenue bases through rapid expansion throughout their territories. Many partners left very little money in their businesses. When I began working with Kinko’s in 1996, no one could say exactly what the company’s overall revenues were nationwide. There were so many inter-company sales and charge back transactions that while we knew sales exceeded $1 billion, we could only guess at the actual number when all the financials were consolidated. Initially, people didn’t believe we could come up with a fair and equitable means of valuing each partnership for a merger. My own partners told me it couldn’t be done.

We gave them four different options for valuing their companies: using 1) 15 times pre-tax earnings, 2) 1 times revenues, 3) $1.50 times the number of residents in their areas, or 4) $300,000 times the number of stores. We knew that adding up all these valuations would result in a total greater than the real world value of a consolidated Kinko’s. So we cut back everyone’s final valuation 50 percent across the board. Bob has been doing mergers and acquisitions for 30 years and still hasn’t seen anything like it. As Bob puts it, “I thought the formula we came up with was really ingenius.” We also guaranteed our partners a salary for the three years following the sale. We made the sale as democratic and as compelling as we possibly could. In return for selling their companies, our partners received stock in the newly merged, or rolled up, Kinko’s. To be honest, none of us thought we could persuade 100 percent of the partners to sell, but in the end, they all did. [AA Comment: This passage made me wonder if he isn’t rationalizing it. Made me wonder what his minority partners and franchisees thought about it.]

In December of 2002, CD&R, J.P. Morgan Partners, the buyout division of J.P. Morgan Chase & Co., along with Kinko’s itself, made a final investment to buy out the former partners. I sold the last of my shares at this time. A year later, in early 2004, FedEx, our former vendor, bought Kinko’s for $2.4 billion. [AA Comment: I remember that day vividly. It was actually in December 2003 that the deal was announced while I was at the beach in Rio. In those days, we didn’t have I-phones, so I only found out when I got back home. People were critical of the deal, as was I.]

My personal physician Bill Morton-Smith once said to me that, by selling my stake in Kinko’s, I staved off a severe case of Tycoon’s Disease, and possibly saved my own life. [AA Comment: Loved this comment. Tycoon disease is when a CEO or founder thinks he can conquer the world. Its become so common these days, we might as well call it a pandemic.]

Make That Change what’s absolutely true: That’s the thing that’s great about repurposing. On the professional front, more and more people these days are getting to repurpose their work lives over and over again. You certainly don’t have to hit “retirement age” to do so. Hopefully, in the process, you get back in touch with something essential in yourself.

Even though I rarely trade (I’m a long-term investor), I love monitoring every little hiccup in the stock market. On a given day, I might check on my investments a dozen times. It’s a challenge that absorbs me mentally and emotionally. A few years ago, as I told you earlier, my cousin Lance Helfert and I started a money management firm called West Coast Asset Management …. I lavish West Coast Asset Management with love. I’m still the 12-year-old kid who ditched junior high to learn how to trade stocks in his father’s account. We eat our own cooking at WCAM. We invest our own money alongside our clients’ money. (To see our newsletter, go to www.wcaminc.com). Though I monitor our every move, we rarely trade because we invest for the long term. The great thing about investments is that they are like grandkids. You can love ’em and leave ’em. Because I trust Lance and Atticus implicitly, when I want to go on a vacation, I can. [AA Comment: I went on the website and got some info which I share below. Their last newsletter is from 2011, but Orfalea is still listed as part of the team.]

We also support learning differences expert Mel Levine, who helps to promote understanding of conditions like dyslexia, ADD, and ADHD through his best-selling books and his organization All Kinds of Minds. [AA Comment: My older son Luca has ADHD and my wife and I like reading books on the topic. I am also interested in personality types and recently read two good books on the Enneagram. One is called Enneagram: Real World Scenarios to Help You Decipher the 9 Personality Types, and the other is called The Road Back to You: An Enneagram Journey to Self-Discovery. Unfortunately, as with books on Bitcoin, most books on the Enneagram are bogus, or heavily biased and dogmatic.]

When I spoke, I told them what it was like for me as a kid with dyslexia, trying to navigate my way through a hostile educational system. I urged them to reconsider some of the ways they teach and treat their children. I told them how something called “sensory integration” can help kids with learning opportunities like dyslexia. Although science has yet to prove the theory’s efficacy, these days some educators believe that developing children’s upper body strength, posture, and coordination can possibly improve their reading comprehension. The fact that I was a skinny kid with little upper body strength probably worsened my own condition; even now, as an adult, I have bad posture. I believe parents can help their kids develop strength and coordination through simple exercises like holding their feet while they walk around on their hands. My wife and I are eager to spread the word about sensory integration.

We intend to complete our donations over the next twenty years, so we can enjoy the giving while we’re still here. I’ve already warned my sons not to count on a huge inheritance. My younger son Keenan’s reaction was, “That’s fine, Dad, but could you do me one favor?” “What’s that?” I said. “Please put an ATM machine on your grave!”

Every morning I start by asking what I want to do with this particular day. I’m still scheduled up to my eyeballs (because I like it that way), but when I first get up, I think about what I want to think about. That’s freedom. I’m surrounded by nice, competent people. They are all far more capable than I at juggling a lot of details that require precision. They are so good at what they do that I no longer have to worry about busywork. With their help, I can get into as many, or as few, of the details as I care to. My life is still built on partnerships. nerships. And it still runs on trust. It’s a dyslexic’s dream.

RESEARCH ON ORFALEA AND HIS ASSET MANAGEMENT FIRM:

Paul Orfalea Wikipedia page: https://en.wikipedia.org/wiki/Paul_Orfalea

West Coast Asset Management sale in October 2014: https://www.pacbiztimes.com/2014/10/17/lucia-aquires-wcam-office-key-staff/

WEST COAST ASSET MANAGEMENT WEBSITE MATERIAL

WCAM PROVIDES exclusive equity, fixed income, and alternative asset management services to more than 100 investors consisting of high net worth individuals, institutions, retirement plans and charitable foundations.

Established in 2000, WCAM is an investment advisor registered with the Securities & Exchange Commission. Our mission is to preserve and enhance the wealth of our clients through a disciplined and entrepreneurial approach to investing. WCAM co-founder Paul Orfalea started Kinko’s in 1970 and his business experience has shaped our entrepreneurial investment philosophy, upon which we base decisions on our own hands-on research.

WCAM PDF: https://web.archive.org/web/20130806052954/http://wcam.com/wp-content/uploads/2011/03/WCAM_Company.pdf [AA Comment: Love how simple and non-salesy this brochure is.]

Our Philosophy

WCAM’s investment philosophy is based on three entrepreneurial tenets: opportunism, focus and involvement.

We focus on the best opportunities and do not limit our investments to companies of a specific size or category. Our investments are focused in separately managed portfolios that we believe represent the most strategic approach to protect and increase our clients’ wealth.

Through our depth of understanding, we believe that owning a relatively small number of stocks reduces risk and enables each investment to have meaningful impact on results. All investment decisions are based on WCAM’s proprietary hands-on research and our principals proudly invest a significant portion of their net worth alongside clients.

WCAM invests in resilient businesses that have a strong, competitive advantage, and generate dependable recurring cash flow. We favor simple businesses that have low reinvention risk and consistently return cash to shareholders through dividends and share repurchases. We are patient and will only invest when the purchase price represents a discount to our estimate of intrinsic value. Capital preservation is a priority and we believe that buying stocks at a discount to intrinsic value will mitigate losses and result in exceptional rewards over the long term.

Our investment team conducts in-depth research and due diligence, including onsite company visits and meets regularly to discus portfolio companies and potential new investments. WCAM maintains a watch list of approximately 300 companies that we would like to own at the right price, and we regularly source new investment ideas through stock screens, investment publications and by monitoring like-minded investors.

LAST WCAM NEWLETTER POSTED

Nothing is Fair in Debt and Taxes

September 2011

“Think what you do when you run into debt; you give to another power over your liberty.”

– Benjamin Franklin

The US debt ceiling crisis unfolded this summer like a bad telenovela. Each day Americans tuned-in to watch the villains, the posturing, the fighting, and the bad acting, and like any good soap opera, we loved to hate the drama. It was like gaping at a train strapped with 14 trillion pounds of debt heading toward the town square. Could it be stopped? Should it be stopped? Who is to blame?

And though the colossal wreck was avoided in the nick of time on August 2nd, the 14 trillion pound train was not derailed and even continues to gain momentum. So we are left with the question;

How will the Runaway train be stopped?

Although we came together as a nation this summer to collectively hold our breath as the melodrama played out in Washington, we remain very far apart on solutions to resolve the debt problem. While any lasting resolution will have to commit to earnest reform in both government spending and tax collection, the idea of extracting new revenue from the rich “corporate jet owner” class in particular has been ruffling feathers following Warren Buffett’s op-ed in the New York Times in August. Mr. Buffett argues that the top priority for lawmakers “is to pare down some future promises,” but he then states that job number two is to “Stop Coddling the Super-Rich” through preferential tax rates. He says legislators “feel compelled to protect us, much as if we were spotted owls or some other endangered species” and urges higher taxes for the super-rich.

“There is no such thing as a good tax.” – Winston Churchill

West Coast Asset Management greatly admires Buffett’s investment philosophy and we value his perspective, so we read his opinion on increasing taxes for the rich with reflective interest. Public reactions to his op-ed have ranged from those applauding his courage and frankness, to accusations of self-serving motives, hypocrisy, senility, and even socialism. Yes, some have accused perhaps the most successful capitalist in our country of being a socialist. The unspoken agreement among citizens of all civilized societies is that taxes are flawed, unpleasant and unfair; no matter the race, social status, or point in history. So when one of the world’s wealthiest individuals and most successful investors argued that he and his $50 billion net worth are not taxed enough, it was received like a broken promise.

“A tax loophole is something that benefits the other guy. If it benefits you, it is tax reform.”

– Russell B. Long, US Senator

Efforts to resolve the nation’s deficit problems have positioned “the rich” as a lightning rod in the political discourse on tax reform. Tax reform sounds like a good idea to everyone; the obstacle is that it means different things to different people. For conservatives, tax reform means rate reductions which incentivize investment and economic growth, while liberals define tax reform as expanding rates for the top income earners. When it comes to taxes, perhaps the only point of agreement is that when assessing what is “fair,” there can be no agreement.

“Be thankful we’re not getting all the government we’re paying for.” – Will Rogers

The point that Buffett made in his op-ed that had the most resonance with us was this: “people invest to make money, and potential taxes have never scared them off.” As entrepreneurial investors, we have long sung the refrain of investing in simple businesses with strong competitive advantage that trade at a discount to intrinsic value. We cling to this philosophy in good times and bad and have confidence that the long-term results will be rewarding. A smart investment is a smart investment.

If Buffett feels as though he is treated like an endangered species as one of the “super-rich,” it might be for good reason. A study by University of California Santa Cruz shows that the wealthiest 20% of Americans enjoy 85% of the nation’s wealth. That figure rises to 93% when home values are excluded from net worth calculations. In other words, 80% of the population is sharing just 7% of the nation’s privately held wealth. Therefore, those at the top become easy targets when the government looks for more money. Many argue that the wealthiest already assume an unfair burden of the nation’s taxes and point to a Congressional Budget Office report which shows that the top 20% of income earners pay roughly 87% of income taxes.

As previously stated, and as Buffett himself points out, taxing the ultra-rich (Buffett suggests raising taxes for only the top 0.3% of tax payers) can not solve the deficit trouble without also tackling the irresponsible spending. Buffett sites that the 400 wealthiest individuals had a combined income of $90.9 billion in 2008. If the federal government swallowed all of that income, every penny, this would cover less than 3% of its costs, or keep the government running at current spending levels for roughly 11 days. Just like teenager who gets into trouble with credit card debt, America too must learn to spend within its means instead of looking to rich moms and dads for rescue.

“This is a question too difficult for a mathematician. It should be asked of a philosopher.”

– Albert Einstein, on income taxes

Tax Old Dogs with New Tricks

Scott Adams, creator of the Dilbert Cartoon, wrote “How to Tax the Rich” in a January Wall Street Journal article and offered some refreshing ideas on how to generate new income from the upper class. He says “fairness is not so much about the actual distribution of loot as it is about the psychology of how you feel about it.” He then suggests exchanging with the rich increased tax revenue for various forms of “time, gratitude, incentives, shared pain and power.” For example, individuals in top tax brackets could get their own car pool lane, skip lines at the DMV, get an extra vote, or could direct a portion of their taxes to specified social services.

He describes these suggestions as “really bad ideas” intended only to get more creative and intellectual minds on the path to solving our problems in new ways. He says “the people who oppose taxing the rich are either rich or want to be someday…and the people who want to tax the rich are mostly the people who think Bernie Madoff is a good example of a rich person. I like any notion of adding some sense of choice to paying taxes.” We applaud this outside-the-box thinking. What if the rich had the same feeling of personal gratification paying income taxes as when giving to their favorite charity? What if they had the confidence that government institutions were managed as efficiently as their local food bank? There are many government services that we all revere and enjoy; the military, the judicial system, education, infrastructure, product safety, yet tragically paying taxes has the same level of satisfaction as giving to the bum on the corner.

“To tax and to please, no more than to love and to be wise, is not given to men.”

– Edmund Burke, 18th Century

Warren Buffett closes his op-ed with “it’s time for our government to get serious about shared sacrifice.” We take this sentiment at face value and appreciate his commitment to seeking solutions for the country’s problems. Americans are entrepreneurial, generous, and patriotic but are left with a lingering sense of injustice at tax time. However, if the sacrifice returned some level of psychological compensation in the form of fairness or efficiency, taxation would be a much less bitter pill to swallow. This newsletter is peppered with three hundred years of aggravated comments on taxation. It is unlikely the tax fairness impasse will be resolved anytime soon. However, Americans are also known for their ingenuity and creativity and it is time to apply it to fixing problems and leave the drama for the soap operas.

BONUS: EXCERPTS FROM AN EXCELLENT BOOK ON ADHD:

Attention Deficit Disorder: The Unfocused Mind in Children and Adults (2005) – by Dr. Thomas Brown (Amazon link)

- The concept of ADD syndrome introduced in this book is not intended to be a new diagnosis, replacing existing diagnostic categories. I am simply proposing a new way of looking at these impairments, of which many, but not all, are encompassed in current diagnostic criteria for ADHD. Other labels have been proposed for this cluster of impairments: “Attention Deficit Disorder,” “Executive Dysfunction,” “Minimal Brain Dysfunction,” “Regulatory Control Disorder,” and “Dysexecutive Syndrome,” to name a few.

- I have evaluated persons with a wide range of intellectual abilities. Some of my patients diagnosed with ADD are extremely bright, employed as university professors, research scientists, physicians, attorneys, and senior executives in business.

- Many people with ADD syndrome have problems regarding money. They tend to make purchases-sometimes relatively small ones like a new shirt, book, or CD; other times larger ones like expensive clothing, computers, and so on-on the basis of how much money they anticipate taking in. Frequently they do not take into account how much of their incoming money is already committed to standing expenses like monthly rent or car payments. This difficulty is especially acute with “plastic money.” Many are shocked to discover how much they have run up in high-interest credit card debt. They tend to think of each purchase as a discrete event without realizing how these purchases and the associated interest fees are accumulating.

- Many with ADD syndrome describe themselves as “overly sensitive” and reacting too intensely to even minor slights or criticism.

- Many, but not all, who suffer from ADD syndrome have noticeable problems during childhood.

- Some children with ADD syndrome are not only uncooperative; they are intensely oppositional-often mouthy, argumentative, and extremely demanding.

- It breaks my heart to see how disappointed she gets when all the other girls get invitations to one another’s birthday parties and she is never invited.

- Although adolescents with ADD syndrome often depend on others for support more do than many of their friends, sometimes they are also an important source of support for others, their family or friends. These are not mutually exclusive possibilities.

- When I was a kid, even all the way through high school, my mother had to hassle me every day to get up in the morning. If she didn’t, I would sleep through school. I’ve never been able to get myself up with an alarm clock. And she had to keep pressuring and reminding me to get my homework and chores done. Even though I wanted to, I just couldn’t manage that stuff myself. You help me with so much, and you’re not even mean about it. I just don’t know if I can change the way I’ve been for so many years. I don’t know if it’s something that can be changed.

- I believe that inhibition, the ability to put on the brakes, is just one aspect of executive functions. Equally important are the brain’s systems for ignition, transmission, and steering. All must interact to operate the car.

- In many schools and families, bright but disorganized and poorly performing students with ADHD are still seen as stubbornly lazy, unmotivated, or defiant.

To publish stories that ADHD is a fictitious disorder or merely a conflict between today’s Huck Finns and their caregivers is tantamount to declaring the earth flat, the laws of gravity debatable, and the periodic table in chemistry as a fraud. (Barkley, Cook, et al. 2002, pp. 96-98)