By Charles Goodhart, 2020 (280p.)

Charles Goodhart is a famous British economist best known for having been a member of the Bank of England Monetary Policy Committee from June 1997 to 2000, and for introducing Goodhart’s Law – which basically states that “when a measure becomes a target, it ceases to be a good measure.” I mention Goodhart’s Law in my book and give the example of the company Ahold and the futility of its EPS growth target. In addition to numerous renowned academic articles, Goodhart has written several books, including a largely forgotten graduate-level textbook on monetary theory called Money Information and Uncertainty (link), which was published as a second edition in 1989. Clearly inflation is Goodhart’s area of expertise – if not his life’s obsession.

In his mid-80s, Goodhart has been warning about impending inflation for over a decade. On March 27, 2020, when the COVID panic was peaking, he penned a piece arguing that the authorities were making a big mistake by printing so much money. In a June 13, 2020 article, he quoted Milton Friedman’s adage that “inflation is always and everywhere a monetary phenomenon,” to reinforce his case. He wrote: “The correlation between monetary growth and inflation has an historic pedigree as long as your arm. This column argues that rejecting the likelihood of (eventually) rising velocity following the current massive monetary expansion requires an alternative theory of inflation that has successfully eluded all of us thus far. Ignoring the potential inflationary dangers is the equivalent to an ostrich putting its head in the sand, and while the path towards disinflation may be well known, it simply isn’t available today.” While the tables and charts in his book are precious, the text was dense, repetitive, and angry. After muscling through it all, I was not surprised by how he chose to close the book: “In summary, an imperfect, inflationary future is coming to our doors faster than we had expected, thanks to the pandemic. Slowing globalization amidst a global trend of ageing will ensure that the future is nothing like the past.” He had me at “alternative”. Will his pet call be saved by the pandemic? I don’t think so, but we shall see.

Not all of Goodhart’s calls were bad. In this 2000 paper, for instance, he rightfully argued that digital money was not going to disrupt central banking. “My esteemed colleagues, Professors M. King and B. Friedman,” he wrote, “worry whether currency and Central Banks can survive the IT revolution. Many other financial intermediaries may disappear, or change their role dramatically, but currency and Central Banks are among the safer financial institutions to survive the next Millennium. Stop worrying.” But then ten years ago, he became obsessed with demographics. Evoking the Philips curve, he began to see recurring apparitions of imminent inflation during a long period of deflation that saw interests rates approach zero globally. In this September 2010 article, he is mentioned as one of only two economists who “believe rates will have to rise earlier and more sharply than expected.” In this article from November 2014, he wrote that economic prosperity would sharply reverse due to “a dramatic shift in the structure of our populations, and the ageing of our people.” Sharp demographic reversal is an oxymoron. It’s just not how it happens. Absent perhaps an very extreme event that exterminates billions (maybe an astronomical impact event), a “dramatic shift in the structure of our populations” does not sound credible. But Goodhart is not the only expert who sees trouble coming. Harry Dent is another notable demographic bear. In this November 2020 video interview he predicts that stocks will crash and won’t rebound for decades. That’s also not how it happens. We need not go much further than Soros, who mentions in The Alchemy of Finance (1987) that bull markets last much longer than bear markets, to refute Dent’s theory.

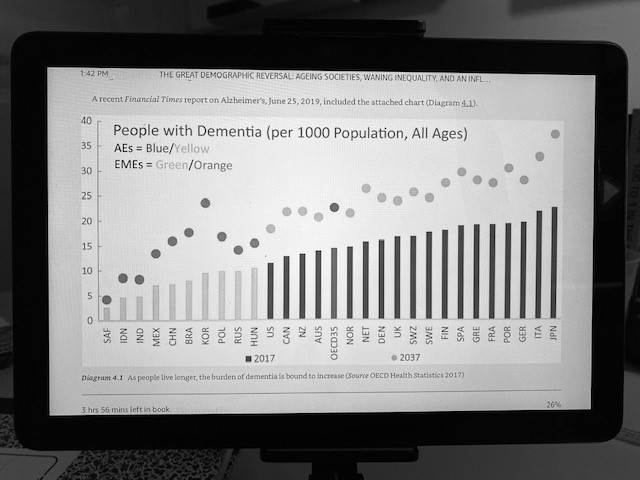

While I respect his achievements, I am not apologetic about my disagreement with Goodhart’s inflation call. I don’t have a strong opinion either way, but at least I accept that I don’t know where it will go from here. Goodhart’s career is living proof that his way of thinking is unproductive. I can see how it might work better in academia, but his hedgehog approach (know all about one big thing) does not work well in the market. His book is valuable because it shares good data in tables, charts, and pictures. For instance, he reproduces a recent Financial Times chart showing dire projections for dementia globally. The book is a good data mining ground for those looking for a credible inflation pitch, but one might also use this data to support investments in drug discovery and brain simulation technology. Goodhart’s work is also helpful for framing how ongoing changes in the labor markets will impact economies globally.

I wrote this review a couple of months ago but did not rush to publish it because I wouldn’t really recommend the book. I think Goodhart grossly underestimates the impact of technology when he dismisses artificial intelligence. He is also too much of an alarmist. The demographic thesis might be persuasive, but that is mostly because it is easy to comprehend and to calculate. The downfall with such demographic calls is that conditions change slowly and social behaviors and reactions rarely follow intuition. The subsequent generations tend to want to do the opposite of what their parent’s did – that we know – but then new imprints keep getting made and new possibilities emerging, while we wait for them to grow up. I hear it a lot, but still find it somewhat silly to predict the behavior of future generations based on how today’s children behave. Bottom line: its unknowable.

In conclusion, despite his achievements and expertise in central banking, Goodhart’s thinking is simple, his book is boring, and his call is wrong. Basically he thinks aging will become a big burden and cause the demand for labor to exceed supply (due largely to the need to care for the aging). He appears to be making the same mistake he made ten years ago, but I suspect it’s even worse, because not only does he dismiss technology altogether, he has been wrong for too long to capitulate. As President Kennedy’s speech writer was credited with saying about the CIA, “often wrong, never in doubt.”

Cheers,

Adriano